Currency War: Germany about to lose 66% of its gold reserves

von Max Keiser und Lars Schall

Jim Rickards lays out a plan to commandeer Germany’s and all foreign depositors of sovereign gold at the New York Fed as currency wars heat up and the ‘nuclear option’ of hoarding and raising the price of Gold is contemplated by an embattled Fed as a way to force down the exchange value of the US dollar.

At “KingWorldNews.com“, Eric King published today an interview with James G. Rickards regarding present and future developments in the gold market. Mr. Rickards is a writer, lawyer and economist with over 30 years experience in global capital markets. He is Senior Managing Director at Omnis, Inc., a consulting firm in McLean, VA and is the leading practitioner at the intersection of global capital markets and national security.

The interview, in which Mr. Rickards states “that the U.S. is the Saudi Arabia of gold,” can be found here as a MP3:

“How can the U.S. be the Saudi Arabia of Gold?“

Max Keiser: „Jim says in this interview that the U.S. has an additional 6,000 tons of gold it can commandeer from the foreign deposits held at the New York Fed (including Germany’s) and move that gold to West Point and give foreigners a receipt.“

“But if the U.S. would just add the 6000 tonnes of foreign gold to their reserves what would be the outcome in terms of political relations towards those robbed nations? Isn‘t then the U.S. something like an outlaw-nation?“

Max Keiser: “The U.S. is already an outlaw-nation. Nobody with any serious net worth complies with any laws they feel are inconvenient for their life styles. When I was working on Wall St. – we were told that it was ok to break any laws we wanted to because ‚the firm has lawyers, and if we need to, we can always get the gov‘t to write new laws.‘ Lloyd Blankfein really does think he‘s doing god‘s work – that he is above the law – that he is the giver of the law.“

Max Keiser also pointed out:

„Just to reiterate – what Jim is saying is what the Bundesbank told me directly when I interviewed inside the Bundesbank for my film for Al Jazeera. I was told that ‚most of germany‘s gold is in NYC‘ this is a direct quote from the PR representative for Dr. Joachim Nagel, Head of the Markets Department at the Bundesbank.“[1]

Chris Powell from the Gold Anti-Trust Action Commitee, GATA, replied to Max Keiser‘s statement concerning his “German Gold Reserve Story“:

“The Bundesbank purported to deny Max‘s story but when pressed they actually confirmed it:

This is a very important detail and I often cite it in my work.“

Related to an essay by former U.S. Treasury Department and Federal Reserve official Edwin M. Truman (in which he is advocating that the United States should sell its gold reserves – see http://www.gata.org/node/9150.), Powell states with regard to Rickards interpretation:

“Rickards construes Truman‘s essay to mean that the U.S. political and financial establishment isn‘t thinking about using gold to restore some strength to the dollar and as a result the dollar will collapse and the world monetary system‘s return to gold will be chaotic rather than rational.

Maybe, but that is to take Truman‘s essay at face value rather than as manipulative disinformation, which most official and semi-official commentary about gold has been for many years.

In any case, Rickards also remarks that its gold reserve makes the United States a gold superpower, the more so since the United States has custody of the gold reserves of many other countries, which, he says, could be commandeered in pursuit of U.S. policy.

Rickards credits GATA for documenting how governments long have suppressed the price of gold but, like market analyst Stewart Thompson, among others, he believes that the U.S. government now wants gold to rise as the best mechanism for devaluing the dollar against the currencies of its trading partners.“

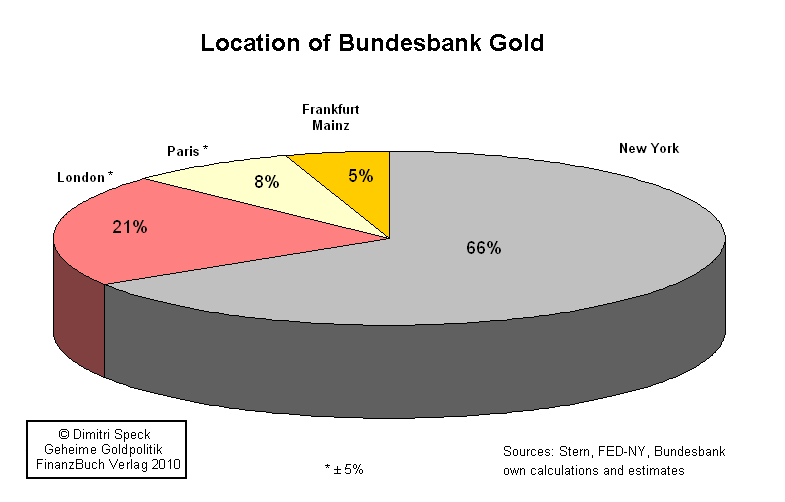

When asked about the German gold reserves, Dimitri Speck, who is the author of the German written book “Secret Gold Policy“, did send us this pie chart out of his book:

Peter Boehringer, head of the Precious Metal Society in Germany, replied to Jim Rickards statements this way:

“It is no secret that the bulk of Germany´s national gold is not in Germany (and has not been since the 1960s when Germany has earned most of the gold through its trade surplusses) but in NYC and London and a little bit in Paris, too. Even the Bundesbank itself has confirmed this part of the story several times – and „defended“ that storage policy with „reasons of trading convenience and historical storage custom.“

As far as [just] GERMANY´s gold is concerned, we are however talking aboutclose to 3,400 tons, not 6,000.

Re Jim Rickard´s „creative“ idea that the US are about to implement an official gold standard and a new gold dollar: Well, I am not so certain about that – because just recently, we have heard an Obama claqueur arguing for an official sale of the U.S. gold:

which sort of contradicts that speculation. Actually I believe that the likes of JPM are in desperate need to cover their short positions and therefore would welcome a sale of these tonnages to them – which in turn would prevent the US from going on a gold standard again by „lack of material“.

But for the sake of argument just imagine for a second Jim Rickards had a valid point: In this case, the US would have to move very quickly, because if China continues to secretely amass gold, in a future gold dollar based world, it could at a certain point establish its own gold yuan, too. So could very soon do Russia and some other current gold buying nations. And do not forget that – in this case, Switzerland, Italy and France were overnight superpowers, too, because of their high gold per capita ratios. Germany would NOT be – due to the reasons mentioned above…

My thoughts so far: Jim is speculating here – actually I would call it wishful thinking of a goldbug. One cannot rule it out. But the US would have to move quickly in order to emerge as a winner of this game. The big winners would be the gold superpowers behind JPM & GS, all goldbugs, all GoldMoney customers, and of course all future SAVERS in the world who would -after 30+ years- finally have a stable currency to save again. Obama however would have to figure out a way for its nation to live within its means and to get rid of the „Keynesian paper money standard“ currently providing 50% of US´s federal budget expenses [1.5 trillion $ p.a.]… Similar story for almost all western nations, too.“

Again Max Keiser: „Please note that Rickards is saying that the U.S. may commandeer all of the foreign Gold they hold on deposit – 6,000 tons (in addition to the 8,000 tons at Fort Knox) – including Germany’s Gold, but exact tonage per sovereign was not spelled out by Rickards. Based on the above analysis, the German component would be approximately 66% of the approximately 6,000 tons “held” by Germany.“

And here‘s the transcript of Jim Rickards on Eric King‘s “King World News“ (emphasis by Keiser):

I think the paper dollar is on its way to collapse but that doesn’t mean the end of the United States or the United States power. What’s really, really interesting to me is that the United States is an awesome gold power. You know we never talk about it because nobody ever wants to talk about gold, I mean no one in an official capacity. But if you think of the world in terms of oil reserves, and people have done that a lot over the last thirty years. You know and the role of OPEC and so forth. You know you divide the world into those that produce oil, those who consume oil. An awful lot of concern has gone into the oil industry and the movement of oil around the world. Well, think of gold the same way. And very few people have ever done this. But when you start to think of the world in gold space instead of oil space, you very quickly realize that the United States is the Saudi Arabia of gold. We have over 8,000 tons. And that’s more than any other country. The euro system has 10,000 tons. These are metric tons, by the way. The euro system has 10,000 metric tons. But that’s a consortium of 16 members, 16 central banks, so it’s Spain and Italy and Germany and the Netherlands and a number of other countries. It’s not all on the books of the European Central Bank. In fact, relatively little is on the books of the ECB, most of it is in the national treasuries of those countries. But, collectively, if they wanted to act as a unit, under the one currency banner, the euro, they’ve got 10,000 tons, so they’re a gold power. Russia is desperately short of gold. China is short of gold. India, Brazil are kind of pathetic. Japan and the UK are kind of pathetic. None of these countries have anywhere near the gold that they need to support their money supply. So the US as we’re a military superpower, we’re also a gold superpower, we’re also one of the ten largest producing countries in the world, producing approximately 200 tons a year out of a total global output of a little over 2000 tons. So we’re producing almost 10% of the world’s output. So we’re a major producer, we’re a major hoarder of gold.

And, in addition to that, there is over 6000 tons of foreign official gold that is stored in the United States that we could always convert if we wanted to. If that gold is at the Federal Reserve Bank of New York, the United States could just secure it. We could send in a military convoy and move it to West Point or some secure US location and then just give the Europeans a receipt. So we could actually up our gold supply to over 14,000 tonnes very, very quickly. So we are a gold superpower.

In a way, the Fed could afford to trash the paper dollar, or at least experiment and risk trashing the paper dollar because if the paper dollar collapses, we could just go back to gold pretty easily. But the rest of the world can’t, especially if we take their gold.

Source:

[1] Compare Lars Schall: „Deutsches Gold in USA?“, published at chaostheorien.de on August 15, 2009 under: http://www.chaostheorien.de/artikel/-/asset_publisher/haR1/content/deutsches-gold-in-usa?redirect=%2Fartikel